Data Intelligence Platform Overview

finAPI Data Intelligence Platform

finAPI Data Intelligence (DI) offers a range of products and solutions based on transaction data. The platform itself is neutral in terms of data sources, but uses finAPI Access as standard. Our current prices can be found on our website.

All backend services are offered as REST API. Ready-made UI processes are also available for the solutions, which can be integrated very easily.

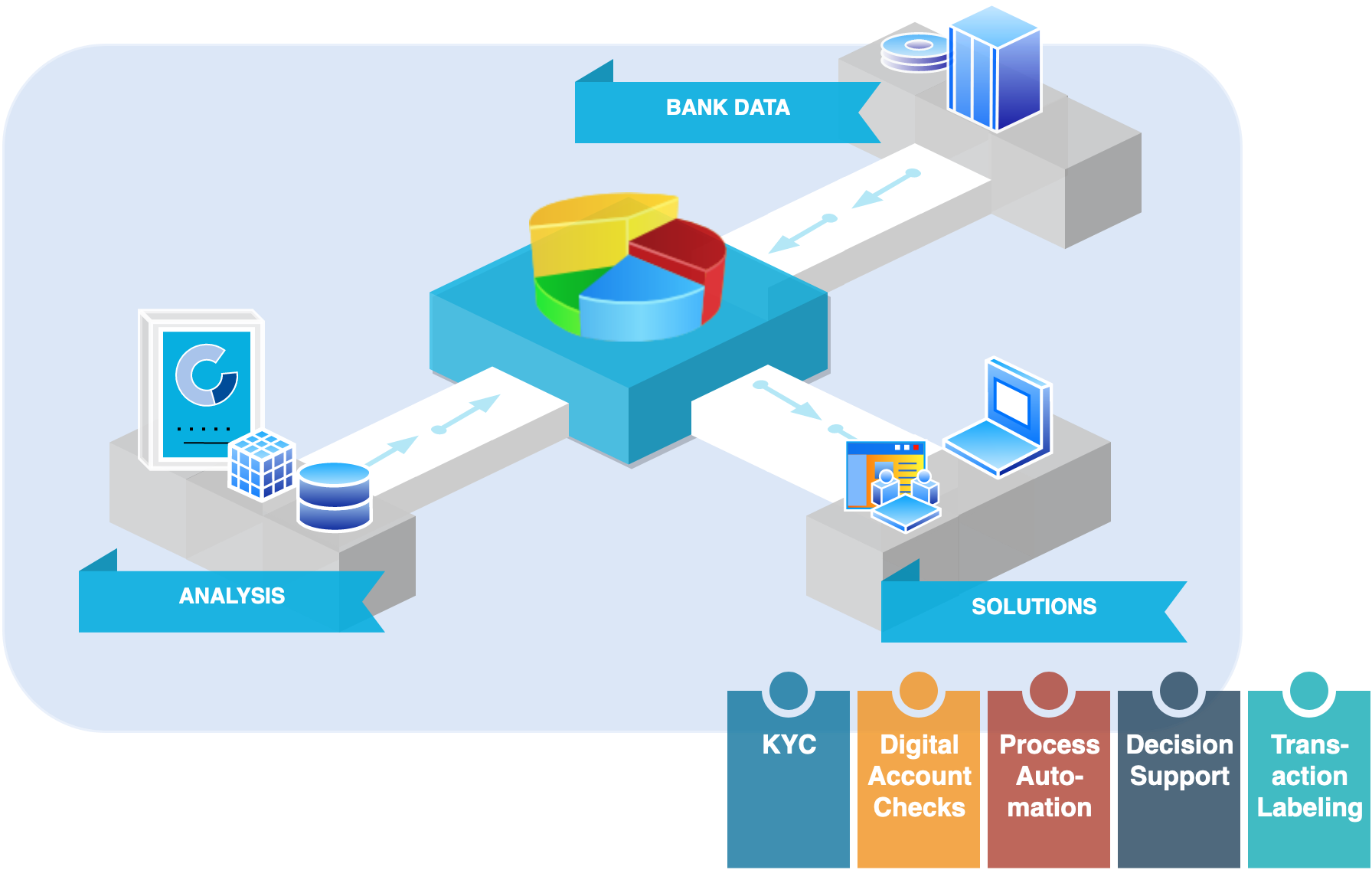

Bank data and analysis are the foundation of all Service and Solutions on a Data Intelligence Products Platform. Based on the insights gained from the analysis of transactional data, DI Services and Solutions are offering unique insights into the facts and behavioural characteristics of end-users, which help our customers create unique value both for them and for their end-users.

Flexible technology components of Data Intelligence Product Platform enable quick and easy development of services and solutions, each of them carrying with it a specific area of application.

Five main areas of solution applcations are:

KYC as a digital identification with the help of online banking is incorporated in our GiroIdent Solutions. More elaborate versions of it are provided in cooperation with SCHUFA.

Account Checks represent a series of Backend and Frontend services (both core and common from tech perspective) integrated in serveral solution. Their main goal is evaluation and calculation of summary KPIs of an end-users' bank account for different purposes, from online payments in (e-commerce) shops, through loan applications and loan decisioning process and insurance contract offers, to debt collection management. From product solution perspective, these services can be combined together for both process automation and decision support applications - examples of such solutions are CreditCheck, LoanValidator, simple checks, risk and cash flow reports, contract detection APIs.

Process Automation solutions are typically combinations of Frontend, UI and Backend services, if needed also SCHUFA DSS engine, and enable easy automation of flows and decission processes for our customers, like e.g. CreditCheck.

Decision Support applications aim at supporting our customers with information needed to make decisions, like loan application decision in CreditCheck. Usually, SCHUFA DSS plays a role in such solution applications.

Transaction Labeling solution is anchored in DI Labelling Service. DI Report Service and all DI Solutions are built on top of transaction labelling. the Labelling Service can be used as a stand-alone solution, and it is “built-in” component of many other solutions and services.

Data Intelligence Module Eco System

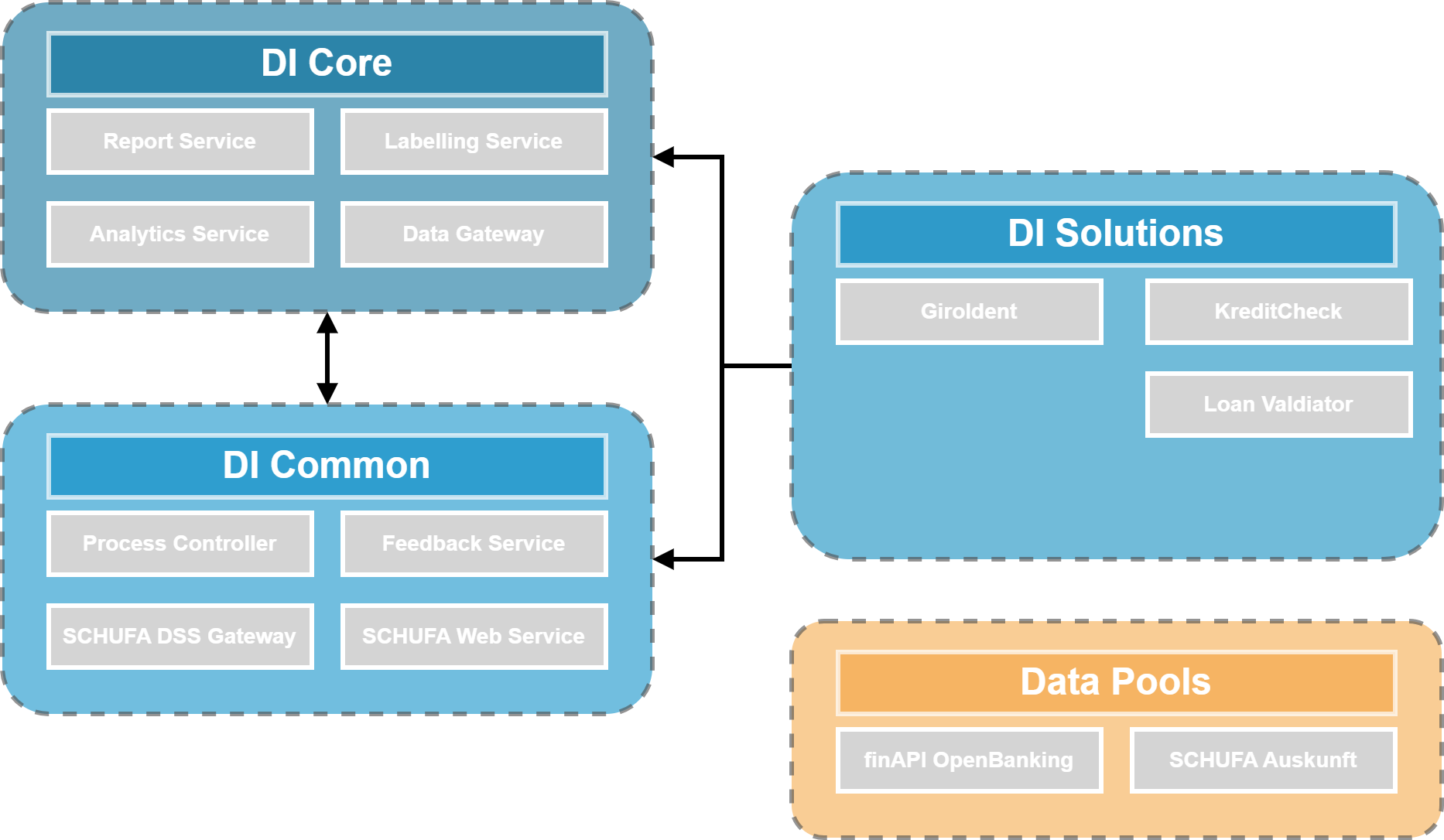

We have divided the entire product platform into 3 main logical areas.

Within these areas, the services act partly as independent services for customers or as backend systems for other parts of the platform.

With this modular approach, we are able to make functions for special requirements directly available to a customer and are not dependent on customers only using the complete solutions that we provide as a product or solution.

A rough overview of this ecosystem can be viewed here: