Introduction Cashflow Reports

Introduction

Cashflow Reports are special views of the customer's cash flow.

They are based on the customer's transactions and account data, which must be imported beforehand via finAPI WebForm or finAPI OpenBanking Access.

All reports have a specific business context (e.g. "Bank and Credit" or "Insurance") and provide additional information in the form of aggregations or monthly evaluations.

Depending on the needs, multiple reports can also be created so that different views or perspectives on the customer's financial situation can be generated.

For example, reports such as "Bank and Credit," "Income," "Spending," or "Rent and Living" may be of interest for loan applications.

It is also possible to combine reports from the "Cash Flow Analysis" category with reports from other categories, such as "Risk Analysis".

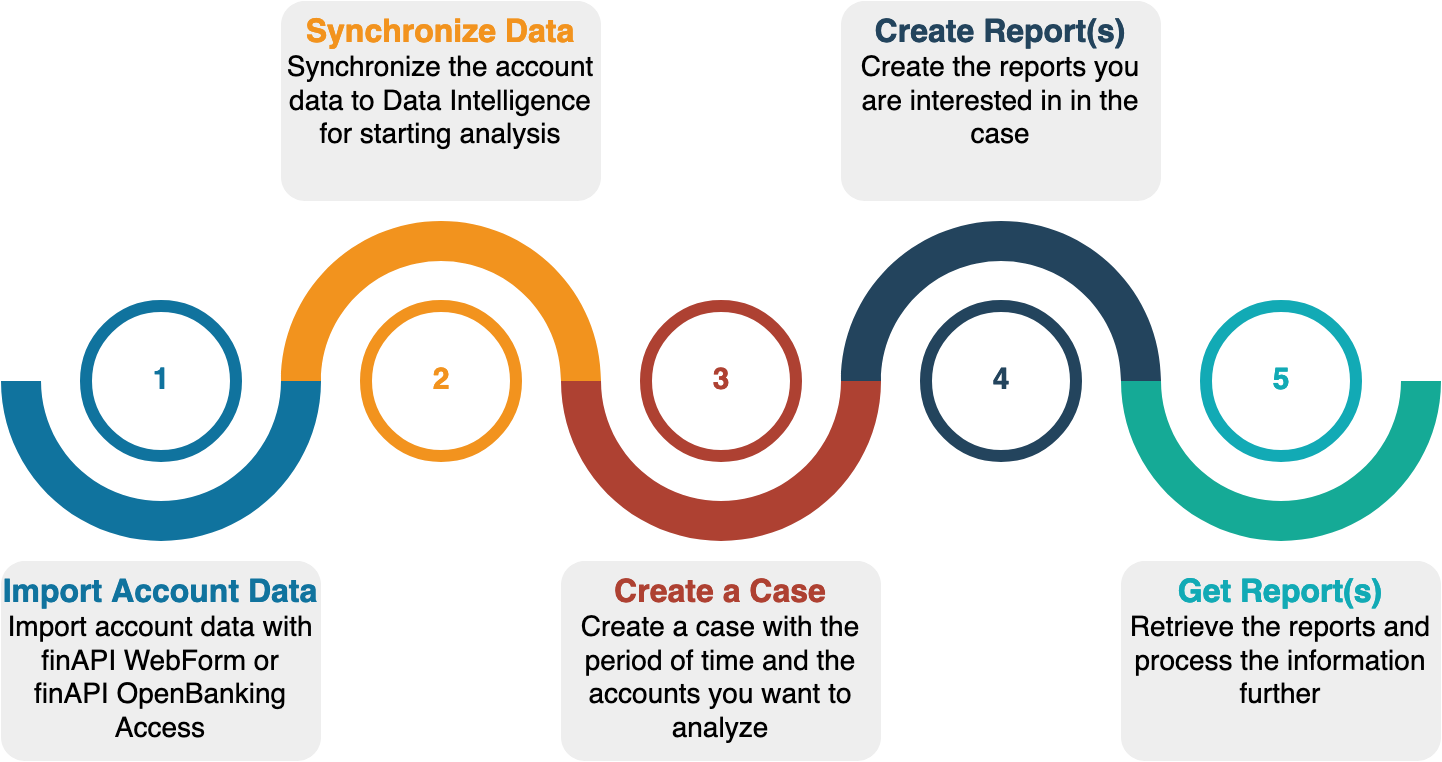

Typical Process with Reports

A typical process with reports is that the customer imports and synchronizes their account data.

Then a case is created, which contains parameters such as period and accounts used.

In this case, the reports of interest can then be created and fetched.