Introduction to KreditCheck

Introduction

KreditCheck streamlines credit decision processes by automating the the analysis of your customer's accounts. This saves time, reduces errors, and provides comprehensive insights. It automatically recognizes, categorizes, and evaluates expenses and revenues based on a predefined rule set that can be customized as it fits your preferences and needs. The results are delivered in either JSON format or a clear PDF, providing bank advisors with well-founded information on the customer's creditworthiness to make informed credit decisions.

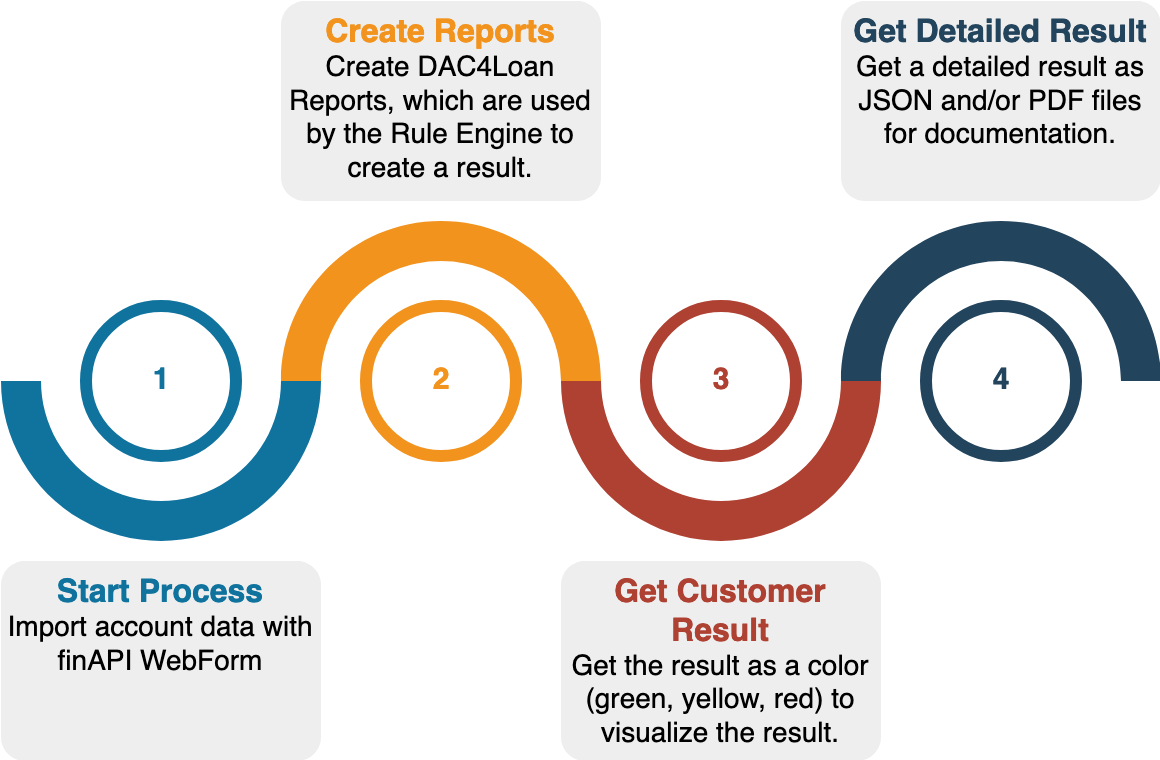

Typical Process with KreditCheck

There are three possibilites to integrate KreditCheck into your credit decision process:

Use our API and build your UI on top of it

One way of connecting KreditCheck is via our API interface. The API interface can be used to access the data pool and thus the raw data. At the same time, a separate UI interface can be used for the customer.

Use our easy-to-integrate UI Widgets

Another option to integrate KreditCheck is through our easy-to-integrate UI widgets. This method requires minimal effort on your side as you can include KreditCheck in your UI with just a few lines of code. This enables keeping your web site design and branding and grants you full access to all relevant data at any time.

Use our Zero-Integration Widgets

The simplest option to use KreditCheck is to include it via a link in an email. and use our web application embedded in your loan application process. Despite its simplicity, this method still grants you full access to all relevant data at any time.