Introduction to KreditCheck B2C Loan Validator

Evaluate your customer's account to make more informed credit decisions.

What it solves

With the KreditCheckB2C Loan Validator, credit decision processes can be significantly accelerated. To make the manual checking of the customer's accounts more efficient in the course of a credit process, our KreditCheckB2C Loan Validator can be used. It helps to reliably assess the creditworthiness of your customers and reduce the burden on your own employees.

The KreditCheck Loan Validator is based on a thorough analysis of one, or more, of the customer's accounts. Various factors are taken into account, including income, cost of living, and possible risk factors.

Thanks to KreditCheck B2C Loan Validator, the credit check becomes much more efficient and bank advisors can make faster and more informed decisions. They receive a detailed report on the customer's creditworthiness, which can serve as a basis for granting loans or other financial transactions.

The LoanValidator add-on extends KreditCheck B2C and enables the checking of credit-validated contracts. This makes it possible to check whether the end customer has correctly entered all relevant accounts (including all loans in their name). This check is carried out by means of a comparison with the credit information stored at SCHUFA. To ensure that the loan applicant whose SCHUFA A report is used for the LoanValidator process is the same person who imported the bank data, the name is compared.

KreditCheck B2C Loan Validator Loan Validator

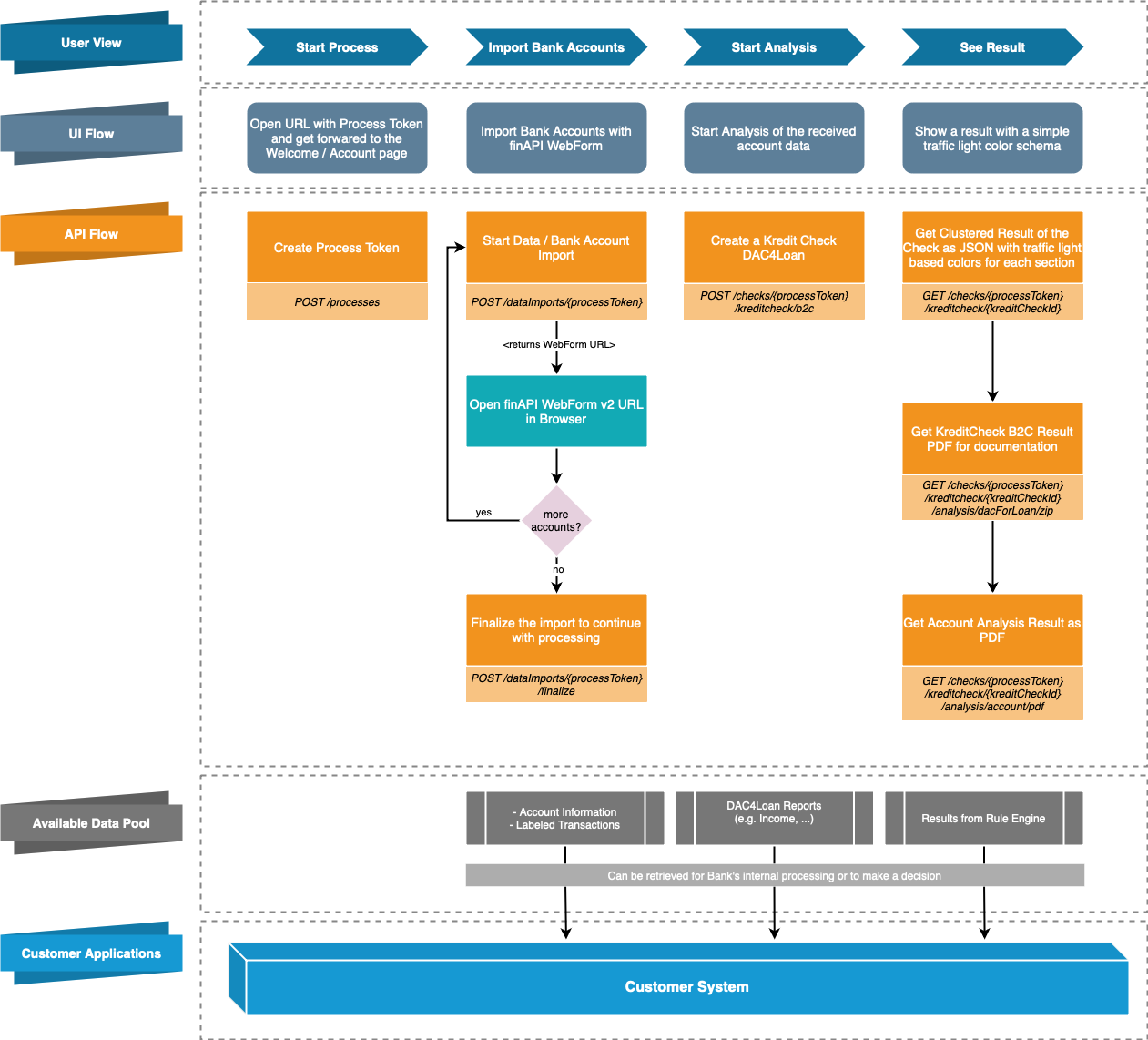

KreditCheck B2C Loan Validator allows financial institutions to analyze their customers through a simple process. As a result, the institution receives a basic recommendation, as well as PDF files for documentation.

The result is determined on the basis of the customer's account data. Various reports and a rule engine are used for this purpose.

The Rule Engine already has a basic rule set, but this can always be discussed and modified with the customer.

As a result, the Bank's final credit decision can often be made based on the result of the credit check, since general rules and also the Bank's individual rules have already been taken into account.

This strong simplification via the API and in the UI makes the process easy to understand for customers and provides all relevant data for the bank without requiring complex integration.

In detail, the process looks like this in an abstract form: